New Visa Credit Cards Are Here!

ACTIVATE YOUR NEW CARDS NOW

All WESTconsin Platinum Visa credit cards have been reissued, despite the expiration date, as we have make a vendor upgrade.

What's NEW?

- Card numbers are new, so remember to update any automatic and recurring merchant payments!

- New vertical card design on front and back! For better security, your card information is on the back of the card.

- The new WESTconsin Credit Union Credit Card Rewards will still give you points on qualifying purchases. How you earn points and what you can redeem them for will remain the same, and your current points balance will roll over! The new portal will still be accessible through WESTconsin Online or the Mobile App. *for consumer cards only

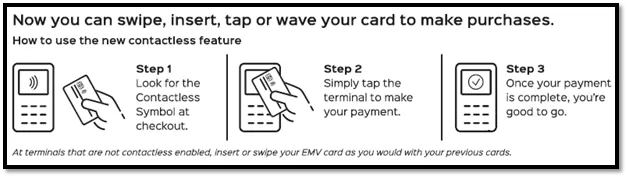

- Tap to pay (contactless) can help make checkouts faster. It also is the safest way to pay since the card never touches the payment terminal, making it less vulnerable to skimming and other types of fraud. Don’t want tap to pay? You can turn it off using Card Management through WESTconsin Online or the Mobile App.

- Card Management allows you to control exactly how and when your credit card is used. Freeze or unfreeze your card, set spending limits, enable real time alerts, and so much more, right through WESTconsin Online and the Mobile App.

- Billing cycles now end on the 20th of each month.

Your rate and card limit are the same. Payments continue to be due on the 15th of each month and your new credit card is still compatible with Digital Wallet.

Business Members | For those with authorized users, please note that starting in June, all statements will be consolidated into one document with each authorized user having a dedicated section. Also, when accessing your credit card online, there will now be a single credit card loan with a consolidated transaction history for all associated users. Finally, current monthly spend limits established for authorized credit card users are now daily spend limits.

New Rewards Program

The new WESTconsin Credit Union Credit Card Rewards program is similar to the old uChoose Rewards on your previous card. You can earn 1 point for every $1 on qualifying purchases that you can then redeem for travel, gift cards, cash back on statement balance, and more!

If you had a remaining uChoose Rewards balance that was rolled over to the new program, it could take 5-10 days to see them in the new portal. The rewards portal is accessible through WESTconsin Online and the Mobile App.

For consumer cards only

Important Dates to Remember

- Late-April, Early-May | Receive your new Visa credit cards in the mail.

- May 9 | Last day to view and redeem uChoose Rewards. Though, you will continue to earn points as we make the final upgrade, and any unredeemed points will roll over to the new program! *for consumer cards only

- May 15 3 p.m. CST | Last day to access and download previous statements and pay your current credit card bill online.

- May 15 | May statements end and include transaction from April 19 – May 15. The statements will be sent in the mail, regardless of eStatement enrollment.

- May 17 | Our offices and Service Center will be closed for scheduled system maintenance, and online and mobile banking and CALL-24 will be down. For the inconvenience, we will be open until 6 p.m. on Friday, May 16 and open early at 8 a.m. on Monday, May 19.

- May 19 | New cards can be activated and used. Old cards will be shut off.

- June 15 | Payment due. Easily pay your bill online, but if mailing, use the new address on your statement. Please note mailed payments will only be processed on business days.

- June 20 | New statement generated and delivered the same way you receive your membership account statements. If you would like to receive them digitally, enroll in eStatements on your membership account through WESTconsin Online, Business Connect, or the Mobile App.

Make a Plan to Pay

Determine how you would like to pay your credit card bill and potentially make some changes to existing scheduled payments before June 15. Convenient ways to pay include:

- Set up a one-time or automatic transfer from your WESTconsin account through WESTconsin Online, Business Connect, or the Mobile App.

- Make a one-time or automatic payment from a non-WESTconsin account External Transfers* or ACH Origination Transfer in online or mobile banking.

- Call the Service Center at (800) 924-0022 or visit your local office.

- Mail a payment to the address listed on your statement.

If you have any questions regarding the credit card replacement process, give us a call at (800) 924-0022. We appreciate your membership!

Frequently Asked Questions

View All FAQSWe are doing this for a few reasons, but the main benefit to you will be giving you the ability to have more control over your credit card, along with offering features that our members have been asking for such as tap to pay. The credit cards will have a new refreshed look, too. We are also excited to be able to now service your new credit cards locally; features such as payment processing and filing fraud and disputes will now be handled directly by WESTconsin during business hours. We are excited to be your one stop shop for all credit card needs.

These will be declined starting on Monday, May 19. You will need to update all your automatic/recurring payments to your new credit card.

Starting Monday, May 19, log in to WESTconsin Online, Business Connect, or the Mobile App and select Card Management to view card details.

Apple Pay, Google Pay, and Google Wallet on Fitbit are all supported Digital Wallets by Visa. Samsung Pay and Garmin Pay are not supported at this time.

Yes! You can manage this as well as many more settings within Card Management online. Turning off contactless payments would turn off tap to pay, as well as Digital Wallet.

We are excited to present our members with a modern look and feel. The vertical design helps to differentiate our credit cards from our debit cards along with other cards in your wallet.

This is a security enhancement. The information is put on the back of the card to increase security and protect the cardholder.

This unfortunately is due to a character limitation (25 characters). The card will function properly.

Yes, you can activate their credit card even after Monday, May 19th. There is not a time restraint on when you can activate their card, however eventually it may be closed due to inactivity.

WESTconsin Credit Union serves members in Wisconsin and in Minnesota. Find a location near you.